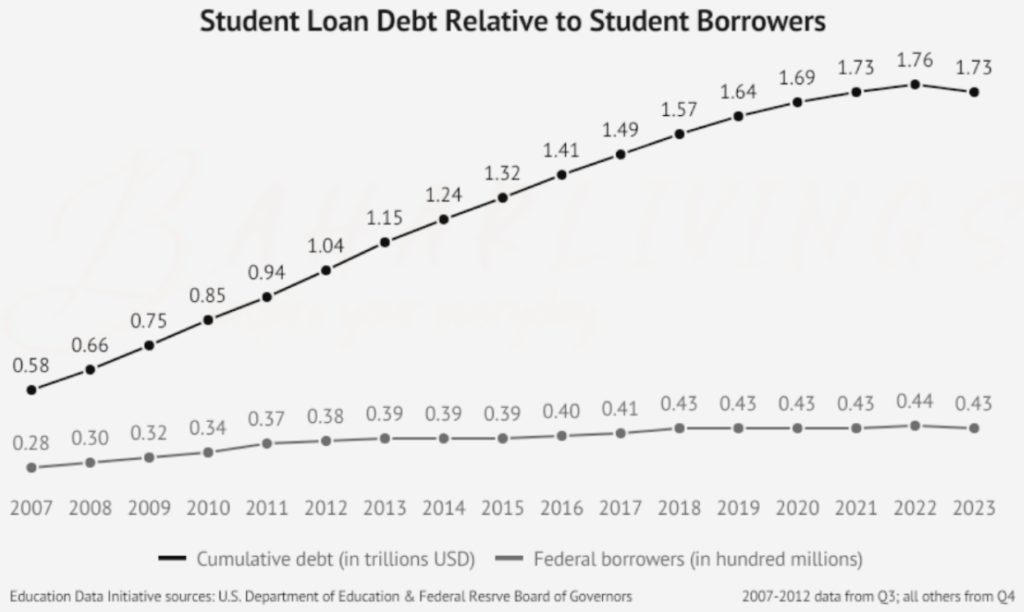

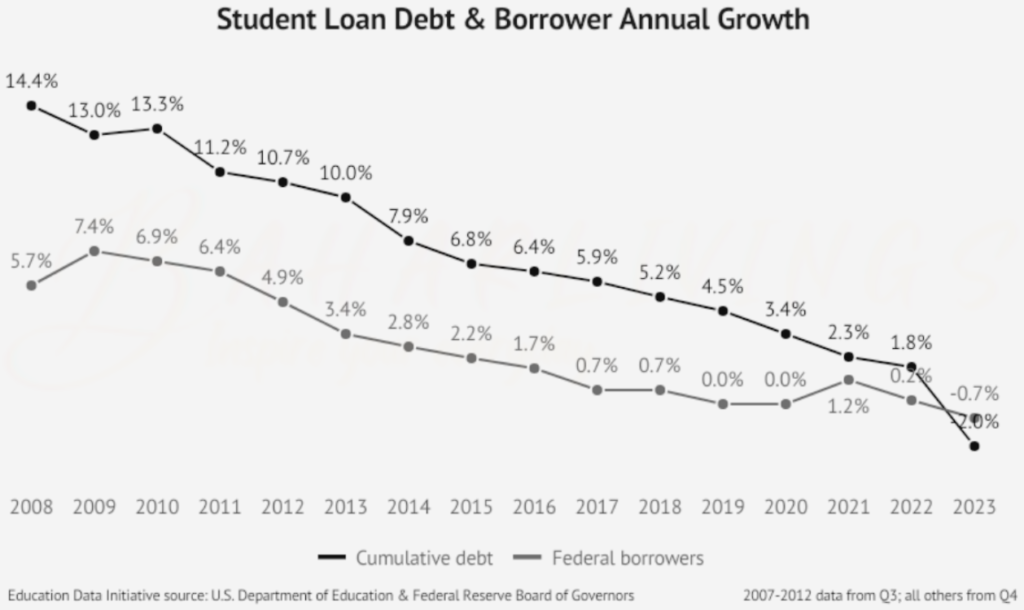

Report Highlights. The student loan debt crisis impacts over 43 million Americans. Rising debt and global hardships have led to new laws.

- Americans owe a staggering $1.75 trillion in federal and private student loans.

- Out of this, federal student loan debt alone is $1.62 trillion.

- About 16.6% of American adults have outstanding undergraduate student debt.

- As of March 2020*, 12.4% of borrowers were behind on their payments, contributing to the student loan debt delinquency rates.

- Currently, 42.8 million federal borrowers and up to 3 million private borrowers carry student loan debt.

In March 2020, a student loan debt freeze reduced the delinquency rate to almost zero (0).

Loan Debt Dilemma for Students: Destroying Future

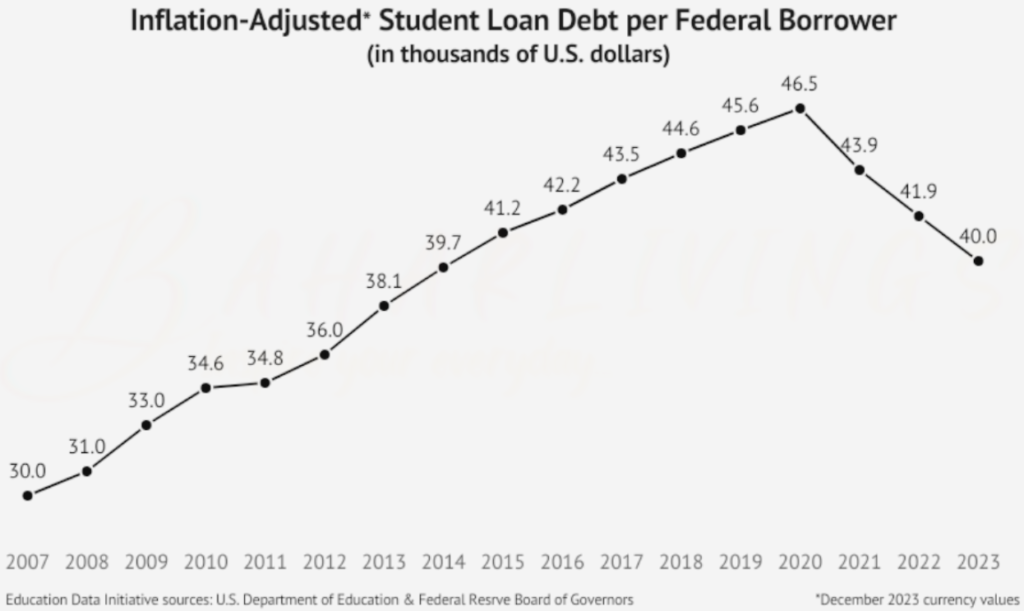

Student borrowers face serious challenges due to mounting debt and wage stagnation. Many graduates and non-graduates struggle to earn enough to pay off their loans. As debts pile up with interest, it becomes harder to make payments.

For instance, in 1996, the average college graduate had $12,750 in student loans, which is about $25,571 today. A decade later, those who still had loans owed around $16,500, roughly $25,591 when adjusted for inflation.

A missing payment can hurt a borrower’s credit score, making it tough to find relief options like refinancing. Without access to new loans for things like cars or homes, borrowers can get stuck in a cycle of debt that’s hard to escape.

- Student loan debt is growing 353.8% faster than the increase in higher education costs.

- In the first fiscal quarter of 2020, $90.5 million, or 12.4% of debt in repayment, was delinquent, even before the CARES Act, contributing to the growing loan delinquency.

- Despite federal relief efforts, total student debt rose by 8.28% in 2020.

- Of that, 11.8% of delinquent loans were in default.

- Around 9% of borrowers from public institutions fell behind on their payments.

- By July 2020, 11.2% of adults with student loans reported missing at least one payment that year.

- Among student borrowers under 40, 15.1% were struggling to keep up with their payments.

- Even after 20 years, half of student borrowers still owe $20,000 in loans.

Historical Context and Key Causes of the Student Loan Crisis

In 1988, the Wisconsin Center for Education Research first used the term “The Urgent Student Loan Debt Crisis: How It’s Destroying Futures” in an academic report. This report highlighted the Guaranteed Student Loan Program of 1965, which offered low-interest, subsidized loans to many college students and contributed to a student loan “bubble.”

Experts in economics compare the escalation of student loan debt to “the housing bubble that sparked the recession between 2007 and 2009” and the subsequent economic struggles. Just as subprime mortgage lending proliferated to create the housing crisis, similar patterns have created the student loan debt crisis.

Although certain financial experts forecasted the housing crisis by 2000, worries about student debt growth rate have been acknowledged for more than 30 years. This lengthy timeline allows for a thorough examination of the root causes. Experts largely agree that excessive federal lending is a major factor behind the American student loan crisis.

- Since 1980, federal spending on student loans has risen 171.1% when adjusted for inflation, nearly tripling in total.

- Over the past five (5) years, the federal student loan program has averaged $92.9 billion annually.

- It comprises 5.93% of the overall federal student loan debt.

- Additionally, federal student aid in the form of grants and subsidies to states has declined alongside state support.

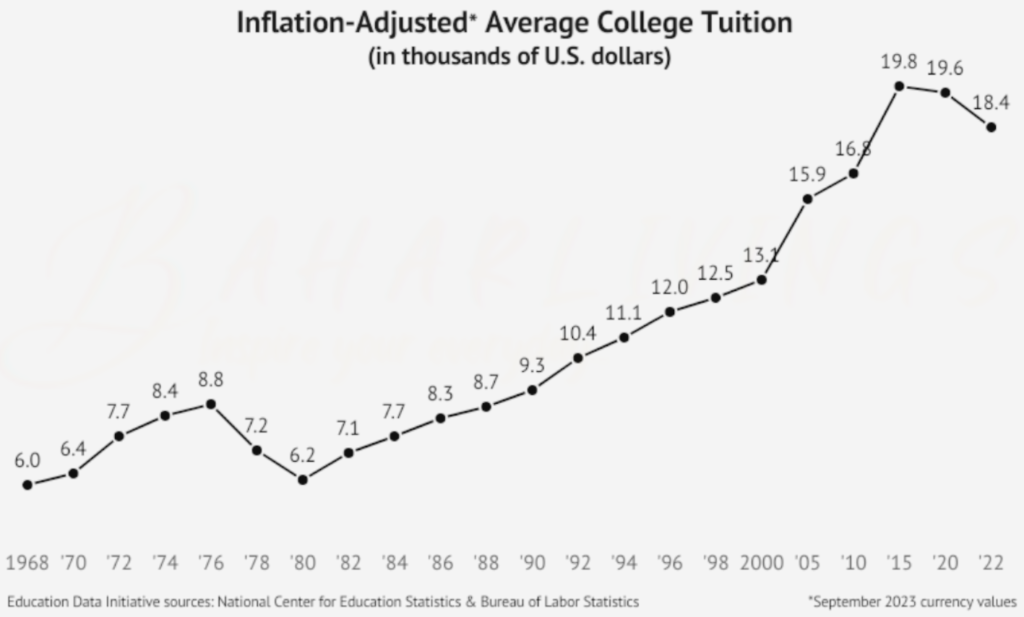

Rising Tuition and Fees

In 1978, the Middle Income Student Assistance Act (MISAA) made it simpler to obtain federal student loans. As more students secured funding, colleges began raising tuition and fees.

Tuition rates at colleges have more than doubled in growth speed since MISAA was introduced. Public four (4) year institutions are raising tuition more than three times faster than they did previously.

Colleges now increase their tuition rates at nearly triple the rate of inflation.

- In this century, the cost of attending college has grown by 6.8% annually.

- This rate is 196.2% faster than inflation and 89.2% quicker than wage growth.

- Public 4-year schools saw the fastest increase, with tuition rising 276.3% since the 1981-1982 school year (adjusted for inflation).

- Before MISAA, public university tuition rose 23.9% over 12 years, at an annual rate of 1.99%.

- After MISAA, public university tuition grew at 6.91% per year, a 247.2% increase in growth rate.

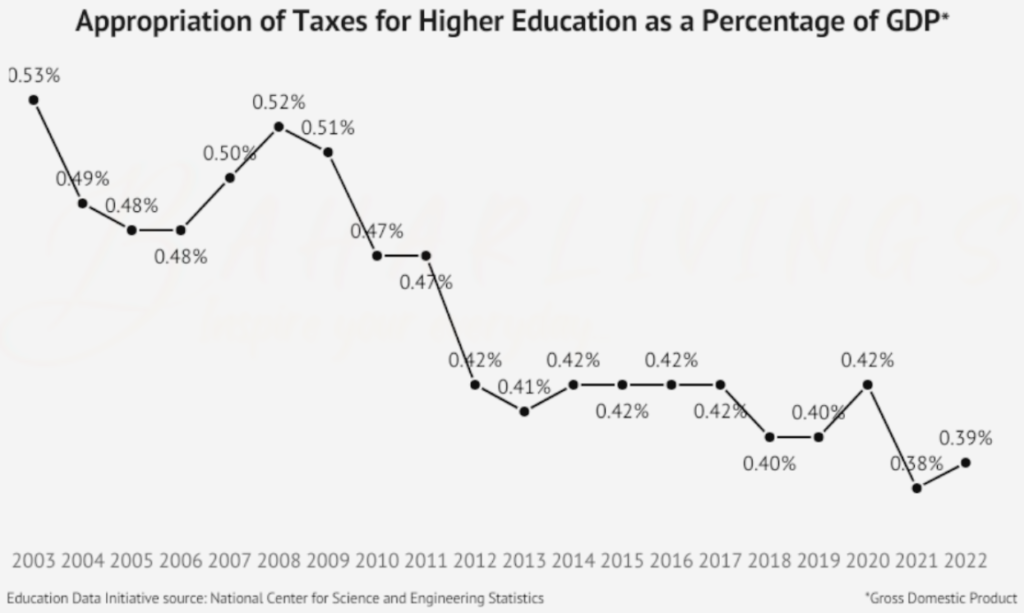

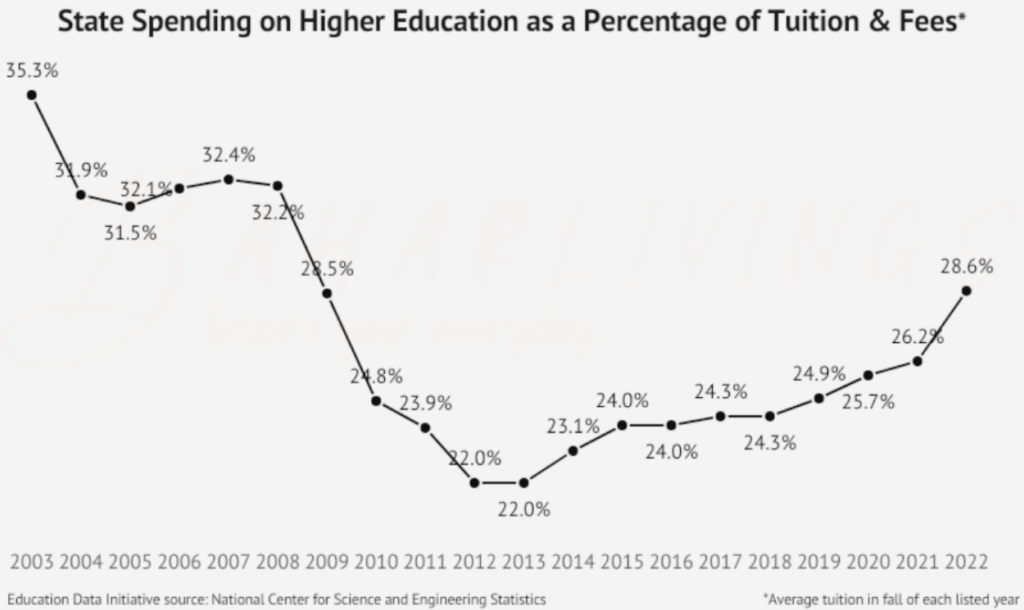

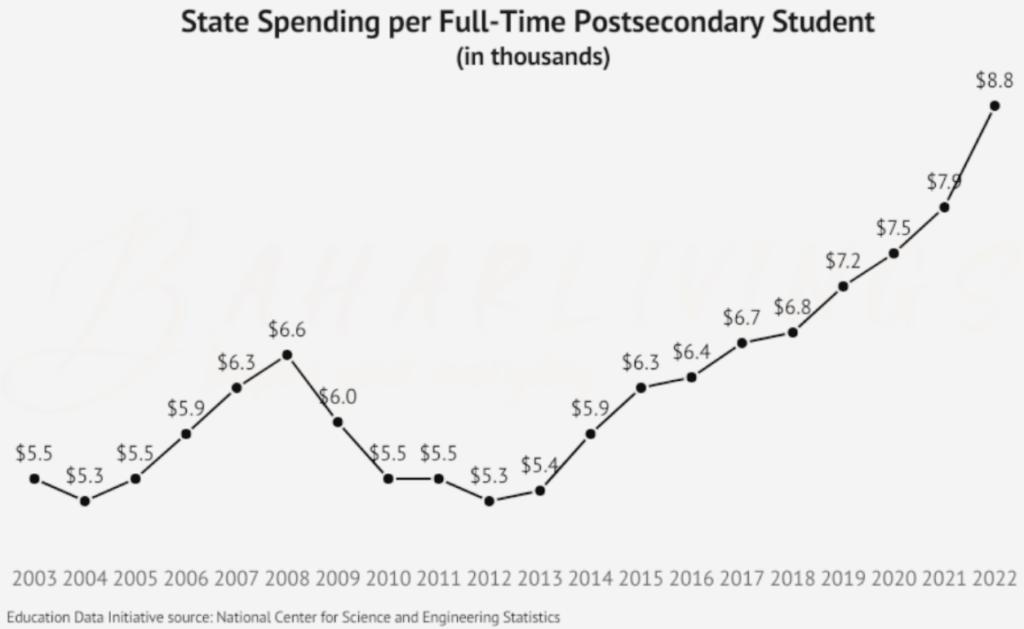

Decreased State Funding for Education

Since the adoption of MISAA, public institutions have hiked tuition at the fastest rate. MISAA also triggered a decline in state support for public education.

Federal grants is now responsible for less than a tenth of a state’s education budget. In addition to MISAA, more federal funds gets distributed to educational institutions, culminating in higher education costs.

As a result, state budgets benefit from federal financing for education. However, state support for education continues to fall faster than spending increases. This suggests that federal and local financing are filling the gap left by lower state payments.

- Education funding from state taxes has seen a 28.1% decline since 2001.

- State spending has increased by 75%, or 21.2% when adjusted for inflation.

- On average, the federal government allocates $1.81 billion per state for student loan programs.

- Each year, states spend approximately $103 billion on higher education, with an average of $2.07 billion per state.

- Most student aid—95.4%—is funded through state and local taxes.

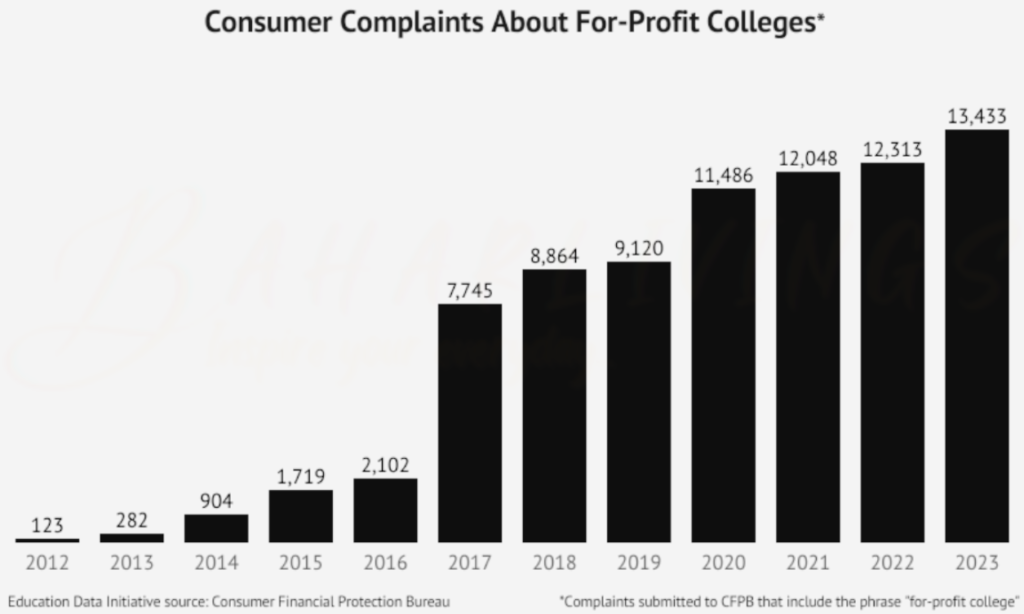

Dishonesty in For-Profit Education

During the adoption of MISAA, public institutions have raised tuition at the fastest rate. MISAA also triggered a decline in state support for public education.

Federal dollars is now responsible for less than a tenth of a state’s education budget. In addition to MISAA, more federal funds gets distributed to educational institutions, culminating in more costly tuition. As a result, state budgets benefit from federal financing for education. However, government support for education continues to drop faster than spending increases. This indicates that federal and local financing are filling the gap left by reduced state payments.

Dishonesty is not only a challenge in schools; it also affects the student loan servicing industry. This industry has come under fire for alleged fraud and fraudulent activities. The United States government has taken action, investigating and suing large loan servicers over loan management practices.

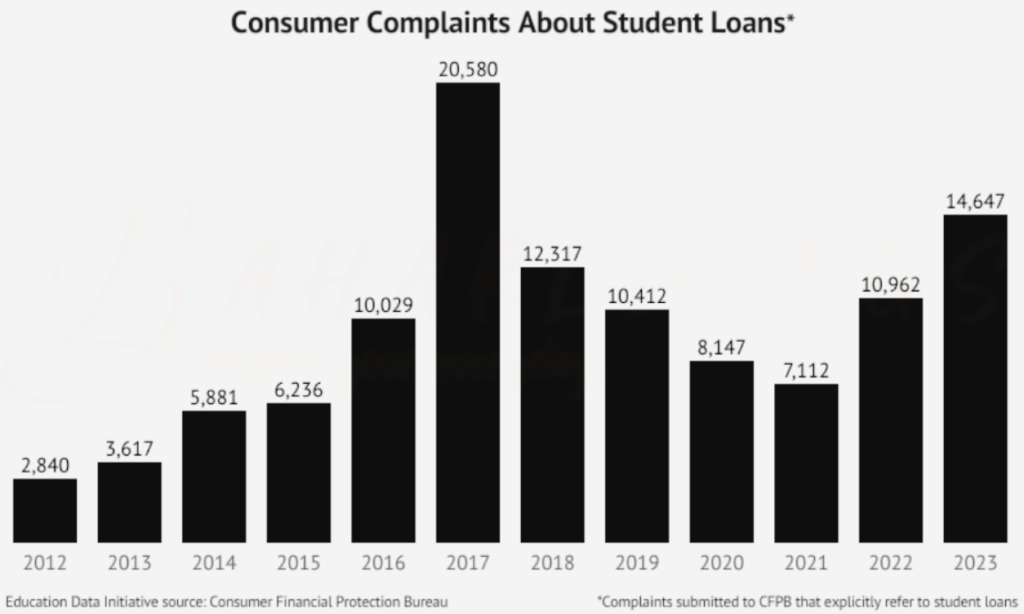

In 2023, the Consumer Financial Protection Bureau (CFPB) received 14,647 complaints regarding student loan services. Among them, 2,295 complaints, or 15.6%, specifically highlighted problems with loan servicers.

- The for-profit college industry’s stock value was $4.8 billion in 1999.

- By 2010, around 2 million students, or 9.6% of all postsecondary learners, had attended for-profit educational institutions.

- Between 1990 and 2010, enrollment at for-profit schools surged by 846.6%.

- In 2010, Corinthian College enrolled 110,000 students, making up 5.4% of all for-profit enrollments.

- For-profit college enrollment has seen a 51.4% drop since 2010.

- In 2018, about 982,410 students, or 5.0% of all postsecondary learners, attended for-profit schools.

- Enrollment in for-profit institutions fell by 10.5% from Fall 2017 to Fall 2018.

- The CFPB reported that 1.8% of all consumer complaints involved student loan services and lending.

- Major lenders like Sallie Mae, Nelnet, and Navient faced lawsuits for fraud and unfair lending practices. To settle accusations of dishonest behavior, these major lenders agreed to pay significant amounts.

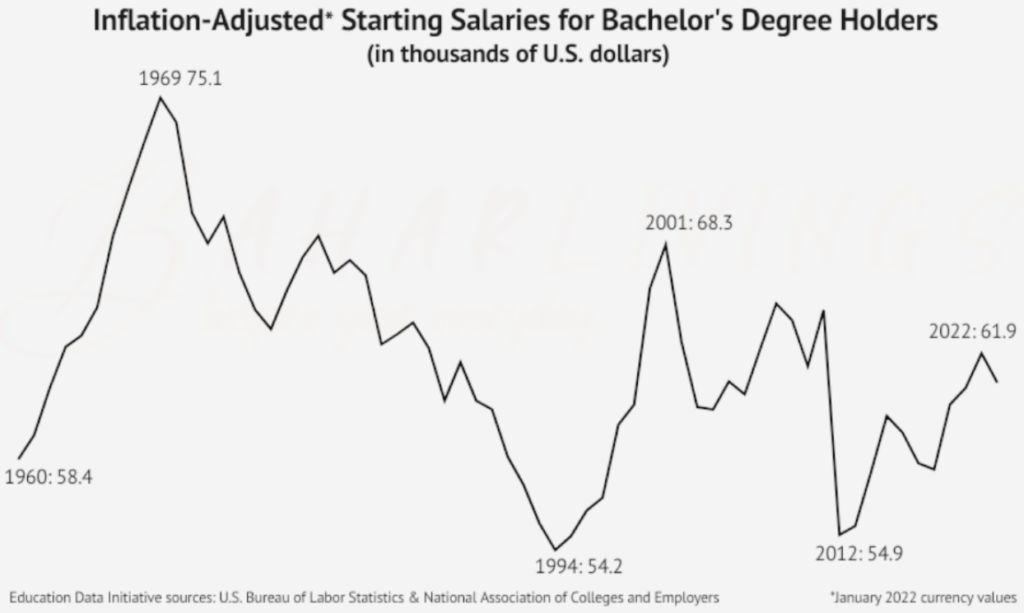

Declining Value of Educational Degrees

The decline in value affects degrees from various institutions, not just for-profit colleges. Average student loan debt is increasing, whereas earnings have remained constant. The issue is referred to as “The Great Wage Slowdown.” Since 1991, the genuine value of wages has declined. Furthermore, in terms of revenue, higher educational degrees are now less valuable than bachelor’s degrees.

Students frequently take out loans totaling more than $40,000 to earn advanced degrees. When comes the time to repay, many borrowers realize that their income is insufficient to cover the interest on the loan.

- Each year, the value of a bachelor’s degree falls by 0.86%.

- Currency has lost 27.7% of its value since 1991, beating wage growth.

- During the twentieth century, median wages grew by 3.40% each year.

- Every year, student loan debt for undergraduates increases by 6.74%.

- While graduate students take 37% of federal loans, they owe 47% of all student debt.

- Graduate students owe 148.8% more in loans than undergraduates. The typical graduate’s student debt is over twice that of undergraduates.

- Workers with associate’s degrees or some college experience earn 15.15% more than high school graduates.

- Earning a bachelor’s degree results in median wage growth of 42.11%.

- Holding an advanced degree increases median wages by an average of 28.63%.

Consequences from the Student Debt Crisis

The education loan debt crisis has serious economic and social consequences for individuals. These challenges have an impact on both daily life and future aspirations.

For low-wage earners, education is far less valuable. The median wage for the bottom 10% of earners is less than half the national average.

Such inequality in wealth drives advanced degree holders, such as doctors and lawyers, to avoid low-income areas. As a result, low-income communities have limited access to basic services including healthcare.

- Most student borrowers take 20 years to pay off their loans.

- Bachelor’s degree holders earn 39.23% less than the national median wage.

- Advanced degree holders have low-end wages that are 21.25% below the national median.

- Employees with associate degrees or some college earn 10.54% more than high school graduates.

- Low-end wage earners with a bachelor’s degree earn 29.19% more than those without.

- For low-end wage earners, an advanced degree boosts median wages by another 29.59%.

Economic Effects of the Student Loan Debt Crisis

The economic impact of student loans may restrict new business growth and postpone homeownership. It leads to in lower consumer spending.

The United States economy has made little improvement in recent years, particularly with mounting student debt. However, there is no direct correlation between market performance and student loan debt levels.

- When a consumer’s student debt-to-income ratio moves by one percent, their expenditure falls by 3.7%.

- People who have more than $30,000 in student debt are 11% less likely to start their own company.

- Borrowers with student loans are 36% less probable to own a home.

- Approximately 13.32% of millennial renters believe they will never be able to purchase a home.

Social Impacts of the Student Loan Debt Crisis

Student loan debt strains social programs and increases the economic divide among different socioeconomic groups. As debt grows, lower-income households face new obstacles. These families frequently struggle to obtain resources that could assist them in improving their position.

This rising inequality creates fewer possibilities for some people, making it difficult for them to prosper. Student loan debt has far-reaching consequences that affect entire communities, not just individual borrowers. It underlines the necessity for remedies to these social imbalances.

- Postsecondary education is held by only 24% of those who use Medicaid.

- Each year, men see their bachelor’s degree benefits decrease by 0.98%. Women experience a 0.75% annual decline.

- In comparison to their White counterparts, Black and African American graduates have an average student debt of $25,000.

- Nearly half of Black student borrowers say student loan debt has delayed their home purchases.

- One-third of Hispanic student borrowers report postponing marriage because of their student loans.

- About 37% of Hispanic borrowers have chosen to wait on having children due to their debt.

The Student Loan Debt Crisis presents significant challenges for millions of Americans, impacting their financial futures and well-being. However, by understanding the underlying issues and exploring various Student Loan Debt Crisis Solutions, borrowers can take proactive steps toward financial recovery. Whether through income-driven repayment plans, federal student loan forgiveness, or seeking alternatives to manage private student loans, it’s crucial to stay informed and make empowered choices. Together, we can tackle the student debt problem and pave the way for a brighter financial future.

Sources :

- U.S. Bureau of Labor Statistics (BLS), Student Loan Debt: A Deeper Look

- ED, Budget History Tables

- ED, Budget History Tables

- BLS, Employment Projections

- BLS, Usual Weekly Earnings of Wage and Salary Workers Archived News Releases

- BLS, Consumer Price Index Inflation Calculator

- National Center for Education Statistics (NCES), Digest of Education Statistics

- NCES, Baccalaureate and Beyond Longitudinal Study

- U.S. Census Bureau, National Population by Characteristics

- U.S. Federal Reserve (Fed) Board of Governors, Consumer Credit Outstanding

- Fed, Report on the Economic Well-Being of U.S. Households in 2016 – May 2017

- Fed, Report on Economic Well-Being of U.S. Households in 2019 – May 2020

- U.S. Department of Commerce Bureau of Economic Analysis, Data

- U.S. Federal Deposit Insurance Corporation (FDIC), The Effect of Student Debt on Consumption: A State-Level Analysis

- U.S. Social Security Administration (SSA), Research, Statistics & Policy Analysis: Education and Lifetime Earnings

- SSA, Measures of Central Tendency for Wage Data

- State Higher Education Executive Officers Association, State Higher Education Finance (SHEF) Report

- National Science Foundation Center for Science and Engineering Statistics, State Indicators

- American Association of University Professors, The Rise and Fall of For-Profit Higher Education

- New York Times, The Great Wage Slowdown of the 21st Century

- National Center for Colleges and Employers, Compensation

- Scholarship America, The Far-Reaching Impact of the Student Debt Crisis

- Canisius College, Life Delayed: The Impact of Student Debt on the Daily Lives of Young Americans

- Macro Trends, U.S. Dollar Index: 43 Year Historical Chart

- Social Science Research Network, The Impact of Student Loan Debt on Small Business Formation

- Business Insider, Student-Loan Debt and Skyrocketing Housing Prices Have Become So Bad That More Millennials Are Planning to Rent Forever

- The Chronicle of Higher Education, Nelnet to Pay $55-Million to Resolve Whistle-Blower Lawsuit

- Consumer Finance Protection Bureau, CFPB Sues Nation’s Largest Student Loan Company Navient for Failing Borrowers at Every Stage of Repayment

This was beautiful Admin. Thank you for your reflections.

Thank you.

There is definately a lot to find out about this subject. I like all the points you made

Thank you so much! I’m glad you found the points valuable. There’s always more to explore, and it’s great to see your enthusiasm for learning more

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Thank you for your kind words and support. I am thrilled, you enjoy the content and really appreciate you sharing it with your network. Excited to have you along and I look forward to sharing more valuable posts with you.

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Nice post. I learn something totally new and challenging on websites

I just like the helpful information you provide in your articles

There is definately a lot to find out about this subject. I like all the points you made

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.